Qualified investor fund NWT FUND SICAV, a.s.

The fund invests in a portfolio secured by unique bank instruments and companies with highly marketable activities.

The fund invests with a high degree of hedging and achieves optimal gains.

The fund is subject to a tax on profits of only 5%. The fund is regulated, monitored and licensed by the Czech National Bank.

Investment objectives of the Fund

To continuously increase the value of funds invested by the shareholders of the fund by means of investments into asset participation in commercial companies and debt securities and by the provision of loans, particularly in the high-growth areas of telecommunications, energy, new technologies and real estate.

The fund invests in a portfolio secured by unique bank instruments and companies with highly marketable activities. The fund invests with a high degree of hedging and achieves optimal gains. The fund is subject to a tax on profits of only 5%. The fund is regulated, monitored and licensed by the Czech National Bank.

The fund provides an effective, transparent and controlled tool for investor cooperation.

Investment scheme of the Fund

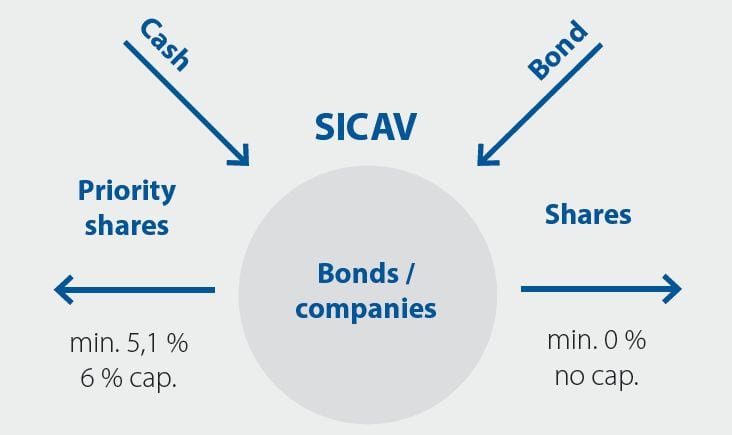

A non-priority share investor deposits bonds with a fixed rate of return of 5% p.a. into the fund, however against non-priority shares, i.e. these bonds serve as the economic hedge for the fund.

The priority-share investor deposits cash and this is used for the purchase of the portfolio of companies and other assets, which will again contain golden bonds in the registered capital of the purchased companies (form of additional hedging).

The proceeds from the fund are assigned to the priority-share investor up to at least 5.1% and are then divided between the priority and non-priority shares up to 6% for priority shares. Non-priority shares have no ceiling.

Why the NWT FUND SICAV?

We are a Czech qualified investor fund operating under the supervision of the Czech National Bank and administered by the largest investment company in the Czech Republic.

Our team has many years of practical experience in managing projects valued in hundreds of millions of korunas.

We are a Czech group with a history – we have been in business in the Czech Republic since 1992.

All transactions are supervised by a depository bank and the fund is subject to an annual audit.

Proceeds up to 5.1% p.a. are preferentially allocated for the benefit of priority-shares.

Any losses of the fund are preferentially allocated to the account of non-priority shares.

The funds deposited by our investors are invested into projects in which we have direct participation.

We eliminate risks by means of industry segment diversification, but at the same time we invest only in industry segments that we understand.

General information

Disclaimers

The value of investment in the fund may both fall and rise, and neither the returns on the initially invested funds nor proceeds from investments are secured or otherwise guaranteed. The performance of the fund in preceding periods provides no guarantee of the same or higher performance in the future.

The NWT Fund is a qualified investor fund. Investors in the fund may be exclusively qualified investors pursuant to § 272 of the Investment Companies and Investment Funds Act No. 240/2013 Coll.,as amended.

Investors should carefully assess the investment strategy and the specific risks that may flow from the investment objectives of the fund, as specified in its statutes or in other documents related to the fund. Detailed information is contained in the statutes of the fund and the Key Information Documents (KID). The Key Information Documents (KID) of the fund are available at http://www.avantfunds.cz/informacni-povinnost/. The aforementioned information is available in printed form at the head office of AVANT investiční společnost, a.s. ROHAN BUSINESS CENTRE, Rohanské nábřeží 671/15 (Reception B), 186 00 Prague 8.

Further important investor information is available at: https://www.avantfunds.cz/cz/dulezite-informace/.

The provided information is only of informative character and does not represent a proposal to conclude a contract nor a public offer pursuant to the provisions of the Civil Code.

Information about the Manager and Administrator

AVANT investiční společnost, a.s., ID No.: 275 90 241, with head offices at Rohanské nábřeží 671/15, Karlín, 186 00 Prague 8, recorded in the Commercial Register at the City Court in Prague, Section B, File 11040

Activity permit resolution:

Resolution of the CNB, ref. no. 41/N/157/2006/5 2007/5698/540 dated 4.4.2007, with legal effect from 4.4.2007.

Information about the Depository

Česká spořitelna, a.s., Prague 4, Budějovická 1518/13a, 140 00

The NWT FUND SICAV, a.s. fund is registered on the list of investment funds with a legal entity administered by the CNB pursuant to § 597, para. 1, letter a) of the Law.

The fund is established for an indefinite period of time.

The fund is a qualified investor fund that, pursuant to § 95 para. 1 of the Law, collects financial funds or financially appreciable assets from multiple qualified investors by the issue of participatory securities and carries out pooled investments of collected financial funds or financially appreciable assets on the basis of a defined investment strategy for the benefit of these qualified investors and furthermore administers these assets.

Kontaktujte nás

NWT FUND SICAV, a.s.

Rohanské nábřeží 671/15 Karlín

186 00 Praha 8

Czech Republic, Europe